Greece ranks 4th among 36 OECD countries for highest tax burden of workers with children

Greece ranks 4th among 36 OECD countries for highest tax burden of workers with children – 2 places improvement compared to last year

Greece had the 4th highest taxation of workers with children among the 36 OECD countries in 2020, improving its ranking by two places compared to last year, according to the comparative tax burden report published by the Tax Foundation and presented in Greece by KEFiM.

Key findings for Greece:

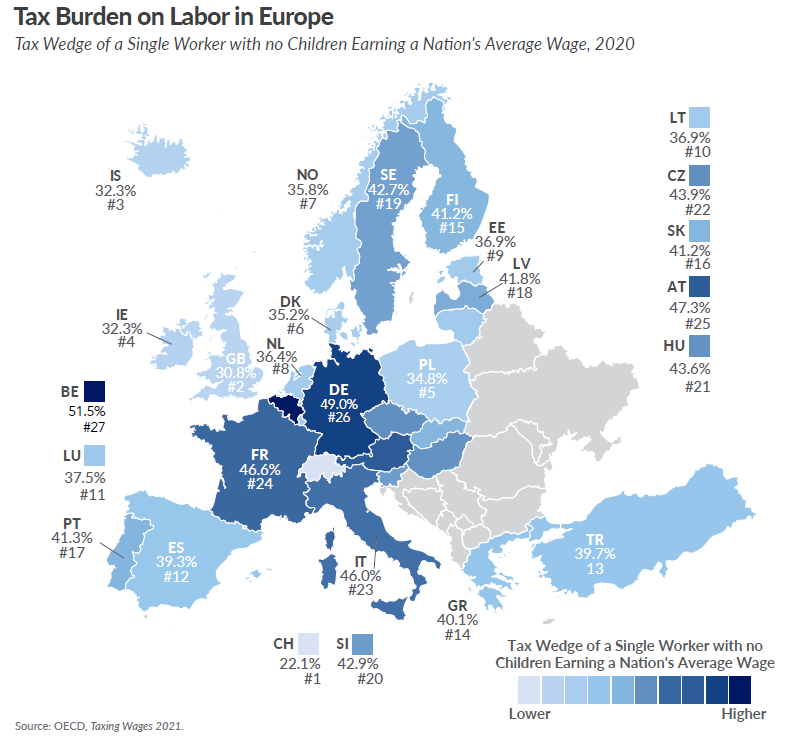

- Compared to the OECD average of 36.1%, the labor tax burden in Greece is relatively high, at 40.1% compared to 40.8% last year.

- The labor tax burden in our country is the 14th highest among the 36 OECD countries.

- Unlike most countries with a high tax burden on labor, Greece does not provide significant tax relief to families with children. Among OECD countries, Greece has one of the smallest differences between the two tax burdens, with 40.1% for employees (compared to 40.8 last year) and 37.1% (compared to 37.8% last year) for employees with families with two children.

- Greece has the 4th highest family tax burden at work, at 31.7% (compared to the second worst position with 37.8% last year), with Turkey at 38.2.

Key findings for OECD countries:

- Medium-income workers in OECD countries paid more than 1/3 or 34.6% of their salary in 2020 in income taxes and insurance contributions. The average labor tax burden has fallen by 1.8 percentage points in the last twenty years.

- The average tax burden on labor varies considerably from country to country. In 2020, the tax burden of an employee in Belgium was seven times higher than that on an employee in Chile.

- In 2020, the average tax burden on households through income tax and insurance contributions was 24.4%, 10.2% lower than the burden on workers without a family. Countries with the highest tax burden on labor usually offer the greatest relief to families with children.

- Between 2019 and 2020, the OECD average tax burden decreased by 0.39 percentage points and COVID-19 measures accounted for roughly one-fifth of that.

- Accounting for VAT and sales tax, the average tax burden on labor in 2020 was 40.1 percent, 5.5 percentage points higher than when only income and payroll taxes are considered.

Σχετικά άρθρα

Επιστροφή στη λίστα

Επιστροφή στη λίστα